Republican presidential nominee and former U.S. President Donald Trump speaks during a campaign town hall meeting, moderated by Arkansas Governor Sarah Huckabee Sanders, in Flint, Michigan, U.S., September 17, 2024.

Brian Snyder | Reuters

DETROIT — Stock prices of foreign automakers, including Chinese and German manufacturers, fell sharply on Wednesday amid concerns the U.S. will hike tariffs on imported vehicles under President-elect Donald Trump.

European-traded shares of BMW and Mercedes-Benz were off around 6.5%, while Porsche was down by 4.9% and Volkswagen declined 4.3%. Shares of U.S.-traded Chinese automakers such as BYD, Li Auto and Nio also were down between 2% and 5% during intraday trading Wednesday.

Trump has repeatedly said he will increase tariffs on many products, including new cars and trucks from China, Europe and Mexico, where many automakers, including Europeans, have established manufacturing hubs.

U.S.-traded shares of Japanese automakers Toyota Motor and Honda Motor also were down during intraday trading by roughly 1% and 9%, respectively. Both also reported declines in quarterly earnings earlier in the day. Over-the-counter shares of Nissan Motor, which aren't publicly listed in the U.S. but can be bought through a broker, were off by 3%.

Trump made several proclamations regarding tariffs during his campaign, including calling for a more than 200% duty or tax to be levied on imported vehicles from Mexico. He also has threatened, as he did during his first term in office, to increase imports on European vehicles.

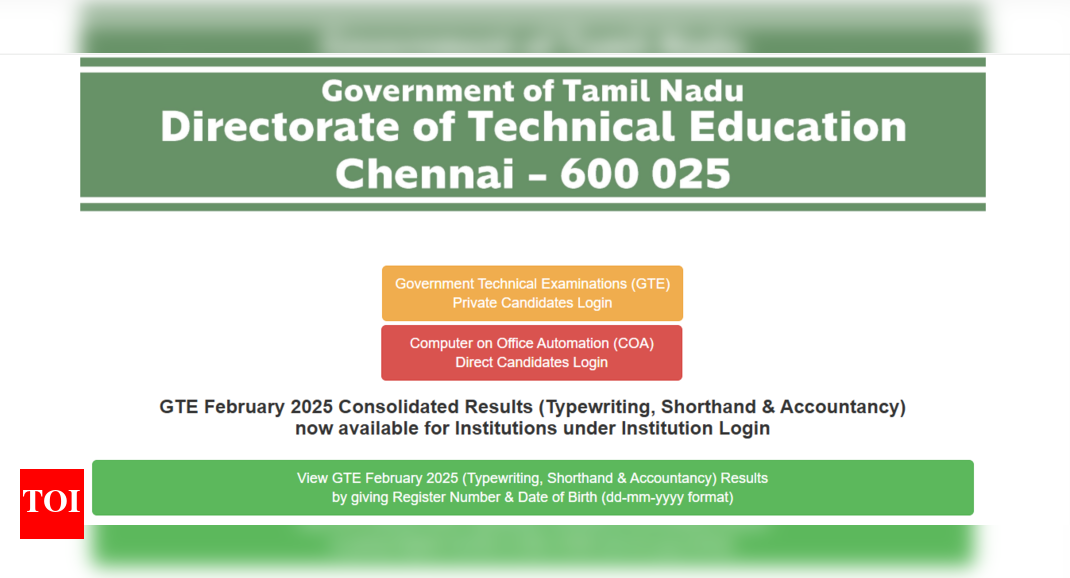

German automaker stocks

Honda Executive Vice President Shinji Aoyama warned of increased costs to the company's operations if there are increases in tariffs. He said Honda produces roughly 200,000 vehicles annually in Mexico and ships about 160,000 of those to the U.S.

"That is a big impact," he said when discussing the company's most recent financial results. "It is not just Honda. … All of the companies are subjected to the same situation. And, in short, I wouldn't think that the tariff will be imposed soon."

Aoyama later added, "Maybe we would go for production elsewhere not subject to U.S. tariffs."

Most major automakers have factories in the U.S. However, they still heavily rely on imports from other countries, including Mexico, to meet U.S. consumer demand.

General Motors, Ford Motor and Chrysler parent Stellantis also have plants in Mexico. So do Toyota, Honda, Hyundai-Kia, Mazda, Volkswagen and others.

Under the previously negotiated North American Free Trade deal, and the United States-Mexico-Canada Agreement, or USMCA, that replaced it, automakers increasingly have looked to Mexico as a less expensive place to produce vehicles than in the U.S. or Canada.

Trump and Democrats alike said they believe the trade deal, which Trump negotiated during his first term, needs to be changed to address potential plans for Chinese manufacturers such as BYD to establish auto factories in Mexico to export vehicles to the U.S.

"They think they're going to make their cars [in Mexico] and they're going to sell them across our line and we're going to take them and we're not going to charge them tax," Trump said Tuesday evening. "We're going to charge them — I'm telling you right now — I'm putting a 200% tariff on, which means they are unsellable in the United States."

Wall Street analysts speculate such tariffs could be hyperbole, citing Trump's plans for an up to 25% tariff on imported vehicles to the U.S. during his first term that didn't come to fruition.

"To be clear, we do not expect aggressive new tariffs in a possible Trump Administration (i.e 100%+). But the challenge for investors will be around rhetoric, especially with the USMCA up for renegotiation in 2026. Trade uncertainty could weigh on Auto stocks broadly, as we saw from 2018-early 2020 (during the height of the US-China trade war & NAFTA negotiations)," Wolfe analyst Emmanuel Rosner said Wednesday in an investor note.

BofA's John Murphy shared similar thoughts: "We anticipate a tougher approach to trade and tariffs although we believe policy changes will be milder than announcements in order to minimize business disruption."

— CNBC's Michael Bloom contributed to this report.

6 months ago

94

6 months ago

94

English (US)

English (US)